Ditch the Stress of Small Business Bookkeeping

/Financial reports help you make sense of the numbers

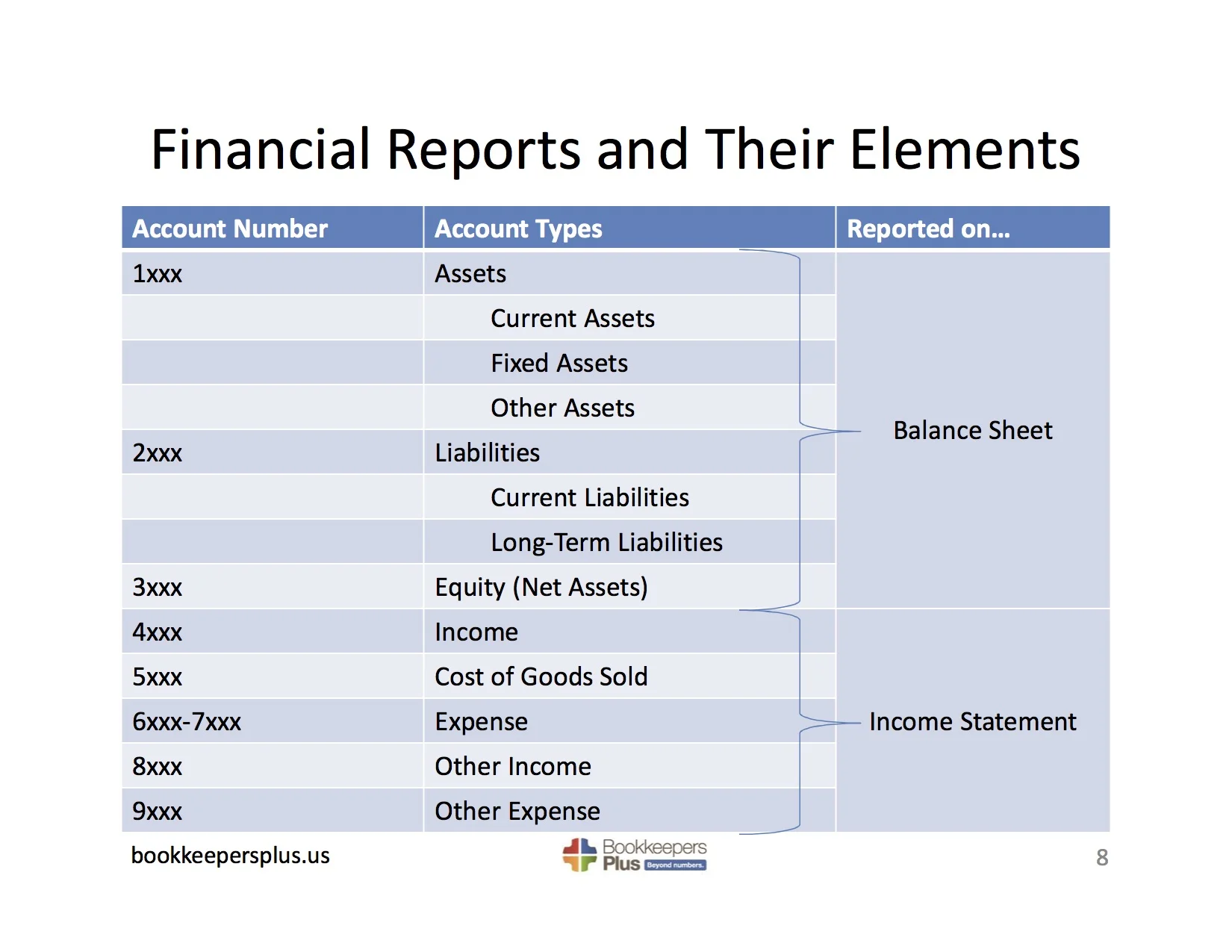

One cause of stress around business bookkeeping is the feeling that one does not have sufficient understanding of what all the numbers mean and which categories to use for various transactions. Working with a professional advisor who can help you understand the numbers can help relieve this stress. To help you get started, consider this – Business accounting all boils down to:

• What you OWN

• What you OWE

• What you EARN

• What you SPEND

ASSETS

What you own are called Assets. Assets are subdivided into current, fixed, and other. Current assets (like bank accounts, inventory, money owed to you by others) are more liquid, i.e. cash or convertible to cash within the near term. Fixed assets (i.e. furniture, equipment, vehicles) are longer term investments in property and are not liquid. Other assets are neither current or fixed. For example, a long-term loan to someone and a security deposit on a multi-year lease are classified as other assets.

LIABILITIES

What you owe are called Liabilities. These can be either current or long-term. Current liabilities include bills to be paid, payroll taxes and sales taxes that are to be remitted, and short-term loans from others. Long-term liabilities are all those not payable within the next year.

Subtract liabilities from assets and you have Net assets, also known as Equity. Equity is made up of an owners’ capital investment and the profits of the company retained in the business.Assets, liabilities and equity is reported on the Balance Sheet.

INCOME

What you earn is called Income. It is the price paid by your customers for the goods or services sold by your business.

EXPENSES

What you spend is either an indirect overhead expense for business operations, sales, and general-administrative activities, or a direct cost of goods sold (manufactured or purchased for resale)..

Net operating income is income minus expense. Other Income and Other Expense is for non-operating activity such as interest, taxes, depreciation, and amortization. Net income for the business is “the bottom line” after adjusting net operating income by the net effect of other income and other expense. Income and expense are reported in the Profit & Loss Statement, also called the Income Statement.

Are you looking to make bookkeeping less stressful? Bookkeepers Plus provides financial management services tailored to help your small business succeed. Contact us today for a free 30-minute consultation.

Tony Solgard, a QuickBooks Certified ProAdvisor, is president of Bookkeepers Plus, located in Cape Coral and Bonita Springs, Florida, and providing bookkeeping services to businesses nationwide. His blog helps business owners understand why accounting details are important and to educate them (or whoever they assign to the bookkeeping function) on how to do it right. The blog offers accounting, bookkeeping, and financial management tips, points you toward small business financial resources, and gives a shout out to small businesses with financial success stories. It discusses the pros and cons of using QuickBooks as well as provides tips to maximize your use of QuickBooks.